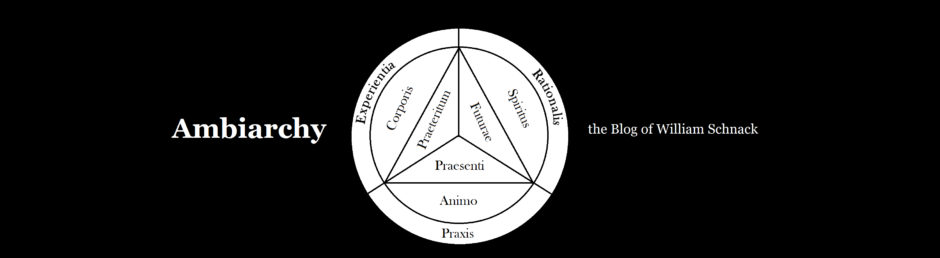

Mutualism can be understood to be distinct from both capitalism and communism, while maintaining elements of each. Mutualism’s most-celebrated founder, Pierre-Joseph Proudhon, was interested in the manner in which theses and antitheses synthesize, and in which antinomies may come to balance one another. Mutuality, or reciprocity, forever approximates this place of synthesis or balance. This places mutualism between capitalism and communism.

One of the fundamental values of mutualist political economy is the idea that prices should be dictated by voluntary costs alone. This is known as the cost-principle, which states “cost the limit of price.” Cost is effort, manual or physical. Any price paid to get someone to work— wages— covers cost. Profit, rent, and interest are prices paid above cost, because they are not payments for work, but for having government privileges, such as exclusive licenses or externalized property protection costs. Landlords, bosses, and private lenders could not exist without government—as they are monopolists who benefit from government privileges—, and because government is simply sustained threat or aggression, their returns fall outside of voluntary costs. Thus, the cost-principle suggests the elimination of all interest, rent, and profit in the economy. Taxes are also to be eliminated, as an obvious form of government compulsion.

Getting back to ol’ Proudhon, he called these returns (at least, is commonly understood in English to have called them)— rent, interest, and profit— increase. Accompanying this terminology, he spoke of the right of increase. For Proudhon, in an effort to internalize costs, the right of increase—the right to claim interest, profit, or rent— was properly socialized, if it were to exist at all. Similar to Henry George—but referring to it as indemnity, or insurance, rather than taxes— Proudhon supported the community collection and fair dispersal of ground rents. Going further, interest and profit was to be eliminated by free competition, or socialized by way of mutual ownership. Taxes were to be abolished through non-compliance.

In many areas, Proudhon sought to eliminate the right of increase, while in other necessary areas he desired to socialize it. For instance, Proudhon wanted to eliminate the right of increase for the individual landlord, but did so by passing it to the community, which defined occupancy and use through payments of ground rent.

The increase in question is not to be understood as any and every gain, but the right of increase refers to, as Shawn Wilbur puts it, “the general belief that having wealth gives one a right to accumulate more wealth […]” Another word that Proudhon and the mutualists use to describe this is usury. What the mutualists oppose is the ability to extract wealth from others without doing so as a form of voluntary exchange for mutual benefit. Involunytary exchanges can be loosely categorized into Proudhon’s concept of increase, or into a wide category of usury, but can be understood more specifically as various forms of interest, profit, rent, or taxation. These are all returns above cost; that is, they are unearned income, gained from exploitation and the threat or use of force.

This seems to be a hard concept for many people to grasp, because we are used to people being able to extract interest, profit, and rent, and even taxes from us, while at the same time calling them friend. After all, people work hard to own their property, or to get their exclusive state licensing, accredited degrees, or other forms of state monopoly-enforcement. Privileges, after all, do not come easy, one has to leap the barrier to entry. Sometimes this means knowingly laying aside one’s principles. After all of this work—at least the honest work—, is a return not to be supplied?

No well-reasoned mutualist would suggest otherwise. Mutualists, after all, believe in compensation for all socially-valuable costs, for all work with sufficient demand. We support the payment to building construction workers in the form of wages, and, when sold, we support the full compensation to the building’s owners in the form of payment. Mutualists do not support, however, the renting out of property. Instead, mutualists desire a society of user-occupiers and occupier-users, where everyone has personal rights to possess that which they are putting to use, so long as their doing so is satisfactory to the wider community. I often call this approach geo-mutualism despite these elements being present in classic mutualism, simply because this element has been forgotten down the line through folks like Joshua Ingalls, but also because the concept was more heavily explored by Henry George, who saw himself as a fellow traveler of, and in part inspired by, Proudhon. In this more clarified version, land is held in common, labor is owned individually, and capital improvements range from personal to cooperative and mutual forms of ownership, depending on its scale.

Mutualists would substitute tenants and landlords, both, in favor of common ownership and usufruct possession, as defined by one’s indemnity payments. In this model, being a member of the community, one is also owner of the land they use, though with others, and so rights of possession between owners are clarified by payments of ground rent, which, under geo-mutualism at least, would be defined by bids on leases. This being so, one is simultaneously one’s landlord and one’s tenant, an owner-user. This form of ownership begins collectively, but is dispersed to the individual for use. Once one has rights of occupancy and use, one may personally possess other forms of capital or real property, such as trucks or buildings.

Mutualists would substitute private lenders and debtors for mutual banking. Similar to the land trust operation described, mutual banking makes one one’s own lender and one’s own debtor in some senses. In this model, everyone owns the bank they use, or at least its policy, similar to a credit union or mutual fund, and so they are their own lender—though collectively so—, and the collective entity lends to the individual, without interest, for the sake of making exchanges. Again, one is one’s own lender and debtor. Once a debt is taken up—upon debit— an individual or cooperative unit has credit, and may begin to make exchanges. One is an owner-user of the money.

Similarly, mutualists would substitute monopoly and exploited for coopetition; natural monopolies under geo-mutualism are owned mutually, with consumers owning the policy and receiving dividends, in the way the community at large does with land. This makes one one’s own monopolist, though collectively so, and one’s own consumer, more personally.

Lastly, mutualism would substitute bosses and workers for owner-operators engaging in various forms of contract. As with those mechanisms described above, this would entail cooperative ownership for many businesses, with duties being fulfilled by individuals. One is one’s own boss—though, collectively—, and one’s own employee—more personally— in this respect. With mutuality comes cooperative self-management. Labor always belongs to the individual.

Mutualism is in part a theory of distributive justice, without ignoring the validity of just process. That is, mutualism aims at distributing wealth more fairly, by actually taking the existing principles of justice to their very extreme, and— when contradictory to one another— balancing or synthesizing them, rather than ignoring them or denouncing them in their entirety. Proudhon’s denial of government was a matter of justice. He was not denying justice itself, but extending its reach, and this left no room for government. Justice is the balance of forces; government is disequilibrium. This is what separates mutualists from both communists and capitalists, without fully excluding them.

Capitalism and communism both represent forms of disequilibrium. Capitalism is a producerist society, a monopolist society, while communism is a consumerist, a monopsonist society. In communism, freedom exists in regard to consumption, and this consumption is protected—at least in hypothesis—by the state. This monopsonistic state tends toward scarcity, as unlimited consumption drains the society. In capitalism, freedom exists in regard to production, and this production is protected—at least in hypothesis—by the state. This monopolistic state tends toward surplus, as unlimited production causes glut. In theory, communists are proponents of democracy, while capitalists tend toward aristocracy or even monarchy; but in practice the opposite has often been the case: Capitalism and democratic republics developed simultaneously, and communism almost always relies on totalitarian authorities. It seems nearly as hard to remain consistently imbalanced as it is to be consistently balanced. However, balance has its rewards, and these command direction, leading even the most passionate communist to give in to totalitarianism, and the democrat to capitalism, the king to the commons, and the proprietor to the vote. Disbalance has been created by narcissists who seek to gain, privately or collectively, and foolish altruists who “pave the road to hell with good intentions,” but the limits to their actions are the gullibility of their prey, and the naivety of their fellows.

Mutuality is the product of the enlightened will, which harmonizes the interests of self with that of the community at large. As capitalism and communism depend on the gullible and the naïve, the clever narcissist and the foolish altruist, mutualism depends on the skeptical (or zezetic) and the wise, the honest and the fair. Mutualism entails a society which constantly adjusts to equilibrium, balancing the forces within itself. Mutualism tends neither toward scarcity nor surplus, consumption nor production, monopsony or monopoly, but toward the satisfaction of needs.

Prices act as a signal to producers and consumers relating to the availability of goods and the need to increase or decrease production and consumption. The law of supply and demand says that as prices increase, demand decreases and supply increases; and as prices decrease, demand increases and supply decreases. This is because consumers like low prices, and producers like high prices; buyers like to spend less money, and sellers like to earn more money.

Applied, if we say that consumers will buy five items at the price of $1 a piece, but that sellers will only produce one item at this price, we can understand that only one item will be exchanged. Likewise, if we say that producers will make five items for the price of $5 a piece, but that buyers only want one item at this price, that still only one item will be exchanged. However, if this is so, we may suggest that the price at which the most items are produced and exchanged is $3, because this is the price most satisfactory to both parties, considering their characteristics.

This is the price at which supply and demand are said to meet, the equilibrium price. It is the equilibrium price because it is the price at which supply and demand become balanced. It is also the cost price, at which cost is met. There is no interest, profit, or rent at the level of this price, but only wages are covered. This is because an equilibrium price can only be determined by the free operation of supply and demand, which implies open competition. Because competing producers engage in price wars, a free market will push the price down as low as it can possibly go, which is the level at which one is compensated for one’s work—is paid wages—, but no more. Wages are covered at this price, but profit is not. Thus, a free market (not to be confused with capitalism) eliminates profit. It does the same with interest and rent.

Some may argue that free markets promote profit, by allowing unregulated natural monopolies to develop. However, in an unregulated free market, natural monopolies are countered by monopsonies, and vice-versa. For instance, governments are always the ones to break up strikes and unions, and they do so for the sake of protecting private property. Without the state, the outcome would be very much different. The two entities would come to form an equilibrium between themselves, in a state called bilateral monopoly. Here, again, prices approximate cost.

Capitalism is often associated with the free market, but this is not actually the case (unless, perhaps, we are to bend historical definitions). Capitalism describes an artificial market in which the state has bestowed property rights to a certain class of individuals— in order that it may more easily funnel taxes through these individuals— who then use their privileges to corner markets, as monopolies and oligopolies, giving them the right of increase. That is, the right to collect interest, profit, and rent, which are prices paid above compensation, and which are thus unearned. These could not occur without state-granted privileges, such as externalized property-protection costs (tenants pay property taxes with their rent, which then pays the cops) or exclusive licensing (much employment is due simply to workers lacking access to licenses, and usury is due to exclusive banking licenses). No pure capitalism can be said to exist, as capitalism requires government to function.

One of the characteristics that make capitalism what it is, is the immense amount of surplus that is built up within it. Capitalism, being a producerist society, builds surpluses. Prices are kept artificially high, by government perpetuation of monopoly, through the protection of private property and market intervention. Monopolies are single-seller price-makers, and sellers like their prices high. At high prices, they produce a surplus, and push it on the economy. This is how our producerist society can be mistaken for a consumerist society: the monopolies build surpluses and then must create an artificial demand through advertising. However, under welfare capitalism (which approaches socialism), many monopolies are given artificial economies of scale through subsidies and such, and so the government pays them directly. Because they are paid directly, they can lower their prices for the consumer (who instead pays an involuntary tax to pay the subsidy), and beat the competition, thereby cornering the market. These are not true low prices, however, as the price has simply been shifted to a tax. The corporate state prefers a small conglomeration of corporations from which taxes may be collected, though it also collects taxes directly (this can only be done so far). The state issues privileges for duties. At the very top of the corporate capitalist state stand the banksters, but the state is otherwise a union of the rich, whose membership—the governing and corporate class— expands and contracts as needed. It is incorrect to see the state and corporations as separate entities.

Communism, on the other hand, is a society built around scarcity. Communism is replete with consumption, as prices tend to be pushed artificially downward. However, low prices mean that production becomes scarce, and communist societies often have to compel their members to work with some means other than money, having functioned on involuntary work camps in the past. Some communist societies intend to exist without, or to reduce the need for, money, but nearly all communist societies have either retained the use of money or have issued vouchers, which themselves are a pretty close relative. Prices seem low under communism, but this is because they have been subsidized through taxation—similar to welfare capitalism— or have been produced involuntarily in work camps. Of course— similar to the manner in which welfare capitalism has taken up some of the approaches to socialism, such as subsidies—, few communist societies are truly or purely communist. Most do have elements of the market in place. “Socialism with Chinese Characteristics,” the ideology of the Communist Party of China, stands out quite a bit, having adopted capitalism as a necessary stage that must be developed before communism can take place. Welfare capitalism and Socialism with Chinese Characteristics are not entirely different, but mostly in sentiment. Each describes a society in which markets function for the purpose of the state, though the state takes different forms.

The fact is that there is a point of equilibrium that can be found, and both capitalism and communism stray from this point of equilibrium, communism on the side of demand-consumption, and capitalism on the side of supply-production. However, having these characteristics leads to over-production or over-consumption, which must be corrected in some manner. Communists have often set into place work camps or issued vouchers, and capitalists have often offered welfare programs or subsidies from taxes to make up for their inefficiencies. That is, being out of balance, each has taken up elements of the other extreme, in order to find some position of balance. Some imbalance, however, must be retained, or the elite do not make their desired gains. The entire purpose of retaining economic imbalance is to sustain and reward power. Under communism, political power is gained through the impoverishment (scarcity) of the masses, and under capitalism it is gained from the artificial affluence (surplus) of the rulers. Capitalism has been most successful, due to its abundance of wealth; rulers under capitalism gain from social surplus, while rulers under communism gain from social scarcity. It’s much harder for a ruler to claim their affluence from a scarce society than it is to claim from an already-produced surplus. While both are ethically misguided, history favors strength to weakness, and so capitalism moves forward much stronger than socialism, with Russia having abandoned socialism in large for welfare capitalism, and China having added its “Chinese Characteristics” (the market). However, welfare capitalism, while not to the same extent, has also adopted characteristics of socialism, such as welfare and subsidization. Of course, over time, the dichotomy between capitalism and socialism becomes quite diluted.

A mutualist economy is neither capitalist nor communist, but finds itself in the equilibrium-zone, facing neither consumerist scarcity nor producerist surpluses. While capitalism pretends to be based on voluntary exchange, mutualism actually is based on voluntary exchange, and while socialism pretends to be better for the whole, it is actually mutualism that can be said to fit this bill. Mutualism harmonizes the interests of the whole with that of each individual, creating a resonance between them that can only uplift.

When I speak of mutualistic resonance, I am speaking about the vibrations between two organisms, be they two individuals, two collective bodies, or one or more of these and the whole. Human organisms resonate in various ways with one another, but harmonious resonation is the longest lasting and the most fulfilling, creating a sort of mutual binding through the benefits given by reciprocity. Reciprocity, the tit-for-tat of giving, is magnetic in nature, having a positive (credit) and negative (debit) charge, bringing individuals together. Social cohesion could not exist without resonation of this sort, unless society is to be mentally herded into obedience, or physically corralled by threat of force, as they are in the liberal and totalitatian states (and even in these cases, there must be an ample amount of resonance amongst the rulers in order for them to impose their rule). While the bindings of mutuality may lose their strength at times, this is usually so due to seemingly external factors, which cause disequilibrium, but which can be eliminated. These factors are those used by the state—taxation, subsidy, compulsion, welfare, etc.—, and which are all grounded in the use of force. Voluntary, consensual, and informed behavior ensures mutual benefit. Reciprocity is neither all-give, as the communist state attempts to be portray itself, nor is it all-take, as private capitalism would have it. Reciprocity is resonation, the mutual giving from one party to another and back. In this, all gain, and none lose to the expense of another.

Communism and capitalism merely switch the scores in a zero-sum game, while mutualism makes use of emergent gains. A game is zero-sum when a gain for one party comes at the expense of an equal loss to another party. That is, if +1 for me is -1 for you, or vice-versa, outside of a mutual framework of reciprocity.[1] I do not consider this a true gain, as one must lose in order to have it. Emergent gains are those that result from the emergent properties of beneficial group activity. Emergent properties are those elements that make a whole greater than the sum of its parts. For instance, emergence is the property that makes a table more valuable than the same pieces in a dissembled pile. A table is more valuable than a pile of parts due to its form and associated purpose, and this extra value—which makes the whole greater than the sum of its parts—is the emergent property. There are some emergent properties to group activity, as well. For instance, economies of scale and scope provide benefits in the way of productivity and consumability, and comparative advantage and division of labor allow for the benefits gained by specialization.

However, emergent gains can be utilized for the sake of an external benefactor, in which case elements of zero-sum games come back into play, and the emergent property is taken from its holder, society.[2] This is described in David Ricardo’s Iron Law of Wages, which suggests that the elite in society will only pay its labor force the bare minimum of subsistence (relative to the standards of the society), holding all surpluses for itself. Because the labor force receives bare subsistence, they have nothing to personally gain in unison, but merely thwart the threat of loss. Were they to maintain their emergent product, and were they not forced to labor, their personal gain would be unquestionable. However, because they are often compelled to labor in such a manner, and because their emergent gains are usurped, it is as if they labored alone, and, at times, even worse, faced a loss, but one less than they otherwise would have if they refused their government.

Proudhon suggests, while not in these words, that economies themselves are emergent, and could not be without their component parts. He acknowledges that the economic elite usurp the emergent gains present to society in What is Property? He says,

The sea, without the fisherman and his line, supplies no fish. The forest, without the wood-cutter and his axe, furnishes neither fuel nor timber.

The meadow, without the mower, yields neither hay nor aftermath. Nature is a vast mass of material to be cultivated and converted into products; but Nature produces nothing for herself: in the economical sense, her products, in their relation to man, are not yet products.

Capital, tools, and machinery are likewise unproductive. The hammer and the anvil, without the blacksmith and the iron, do not forge. The mill, without the miller and the grain, does not grind, &c.

[…]

Finally, labor and capital together, when unfortunately combined, produce nothing. Plough a sandy desert, beat the water of the rivers, pass type through a sieve, — you will get neither wheat, nor fish, nor books.

[…]

Tools and capital, land and labor, considered individually and abstractly, are not, literally speaking, productive. The proprietor who asks to be rewarded for the use of a tool, or the productive power of his land, takes for granted, then, that which is radically false; namely, that capital produces by its own effort, — and, in taking pay for this imaginary product, he literally receives something for nothing.

Emergent gain-capture for private use accounts for much unearned income. Interest, for instance, is the return to the use of capital, which is nothing but the technological emergence created through the resonance of human ideas throughout the millennia. Without our ancestors having come together, working in groups or sharing ideas, and had they instead remained atomized, technological progress could never have been made.

A society is greater than the sum of its individual parts. However, for a society to exist, its individual parts must be in at least some accordance with one another, and for a society to thrive, it must learn to successfully harmonize and fully resonate. This can be done only so far as a societal order is found beneficial for its constituent parts. To the degree it is not, it will not last, outside some external influence, such as that which has put us in our current condition: the varying grades of Earth, which we have yet to readjust and harmonize our societies to, but which we are ever so slowly waking up to realize. This external influence—ground rent— realized, societies may refashion their customs to eliminate its burden, and once again resonate with their members. Socialism and capitalism are both beyond the grounds of harmonized social resonance, because both are out of equilibrium for the sake of their ruling classes. It is unfortunate that our customs allowed for the primitive monopolization of ground rents. This has allowed for power not only to privatize[3] the common gifts from nature, but to use these private resources in order to extract the personal and collective gains from others, as in a zero-sum game. In doing so, the ruling class has privatized progress itself.

While mutualism can be considered capitalist or socialist by stretching current definitions, it is really neither, as both capitalism and socialism are exclusive of one another’s valid principles, while mutualism is inclusive of the principles of each. Lay socialists, in their attempts to care for society, merely wish to switch zero-sum scores from the affluent members of society to those who are less so, as a sort of subsidy. They intend to do this through collective ownership of industry. Lay capitalists, in their attempts to care for themselves, intend to keep the present system of property in place, which empowers their rulers to extract zero-sum scores from the people’s board to their own. Proudhon acknowledged that,

Communism is inequality, but not as property [capitalism] is. Property is the exploitation of the weak by the strong. Communism is the exploitation of the strong by the weak. In property, inequality of conditions is the result of force, under whatever name it be disguised: physical and mental force; force of events, chance, fortune; force of accumulated property, &c. In communism, inequality springs from placing mediocrity on a level with excellence.

Unlike the others—communism and capitalism—, mutualism is a place of balance, exploitation of none by none, a steady “Pareto efficiency,” wherein gains are always maximal. Unlike socialism— which seeks to enslave the endowed at the expense of the unendowed—, and capitalism—which seeks to enslave the unendowed for the endowed—, mutualism seeks the harmonization of interests, so that emergent gains can be benefitted from proportionally. While capitalism may make use of emergent forces of production—monopoly—, and communism of emergent consumption—monopsony—, mutualism harmonizes these polar forces into bilateral reciprocation, producing neither glut nor want.

Mutuality provides for a society of abundance. When emergent gains can develop from the harmony of social resonance, everyone lives in varying grades of affluence, with none stricken with poverty, or seen as politically inconsequential. Abundance can be separated from surplus by the fact that abundance is gained without extra effort. Capitalism and communism provide abundance for their elite, who gain without socially-useful (voluntarily compensated) labor, but this abundance is the result of societal scarcity or surplus. While the elite have abundance, the masses of society are poor, either to lack of production (communism) or to lack of consumptive power (capitalism). Societal surplus—capitalism— comes at the expense of personal scarcity (poverty); and societal scarcity—communism— comes at the expense of personal surplus (free consumption). Societal abundance, however,—mutualism— comes at no personal expense, but is true abundance. While workers under capitalism produce a surplus of goods they have no access too; and while under communism—lacking pay— they have no incentive to produce, but have vouchers from the state to consume past their means; workers under mutualism are incentivized by the offerings of emergent gains, provided them by nature. As these gains are cooperatively produced and managed under mutualism, they provide society abundance, rather than surplus. Surpluses describe that which took effort, but which is not put to use; while abundance describes a lack of effort, but a cornucopia of enjoyment. When the returns are contrasted with the costs, there is no extra effort in beneficial group activities, and these activities will be taken up voluntarily if left to their own accord. They need no compulsion, but are gifts from nature. They spring forth from the power of solidarity.

Emergent gains are as natural[4] as any other occurrence in the Universe, but they must be understood metaphysically, rather than physically. There is no strictly empirical solution to emergence, as emergence is a property of will. Emergence seems constructed from the desires of its constituents. As our four dimensional presence applies force to build the table from mere parts into a finished product, giving it purpose and form, however, so too are we manipulated by the telos. The telos commands our will, leaving nothing truly free except a sense, gained from the mystery of self and the mystery of our maker, which makes us blind to the strings on which we are strung, strings of emotion and thought, components of consciousness, which stretch from the very beginning of the physical Universe to its very end in pure mind. Lacking a sense of the hands which put us together and which guide our actions, we naively believe we act on our own accord, and yet it is want, desire, which commands us, and which can only be satisfied by reaching some ends. As Aristotle put it long ago, “Every art and every inquiry, and similarly every action and pursuit, is thought to aim at some good; and for this reason the good has rightly been declared to be that at which all things aim.” Good is the final emergence, the telos, and it commands us to be. Mutualism, by accidentally recognizing this fact, is destined to come into play.

[1] If the +1 is understood to be a debt, to be repaid, it is not a unilateral relationship, and so does not represent a zero-sum game in itself, but uses a zero-sum game (credit and debit) as a tool to facilitate relationships in order to reach emergent gains. When I am describing zero-sum games, I am rather describing a situation in which one party unilaterally benefits at another’s loss, outside the framework of voluntary exchange. Emergent gains may make use of zero-sum games, such as credits and debits, but only under the premise that a debit is to be repaid.

[2] Because the laborers do get a return from their labor in the form of wages, the principles of zero-sum game are to be applied to the surplus (interest, rent, profit) or emergent properties, and not total income.

[3] Even in communist societies, the wealth is privately controlled by the elite.

[4] The term nature has many meanings, which at times contradict. Here, I mean nature as something that is readily occurring in the world, but which is not necessarily but may be, restricted by the laws of physics as uncovered through empirical science.