Introduction

There are different senses in which we may address the concept of monopoly: We may use the natural-artificial paradigm, wherein some monopolies are designated a status of “natural” while others are considered to be “legal” or “artificial” monopolies. We can use the term to describe the concentration of power internal to an institution, rather than as a participant in the market. Monopoly, as a single-seller, can be distinguished from monopsony, a single-buyer, or can be used in a general sense to refer to both of these. I will address each use of the term, before discussing their management and resolution.

Artificial, Natural, and Supernatural Monopoly

Artificial monopolies are created through direct interference or manipulation by the state or government in the market, by taxing, subsidizing, zoning, etc. When a government extends licenses, zoning permits, subsidies, or unfair taxation, artificial monopolies are created, because others have a hard time getting licensed, setting up shop, or competing with subsidies or unfair taxation. With these monopolies, considered to be artificial, the state has taken a direct role in their establishment, through subsidies and other privileges, and does not merely protect previously-granted claims through standard property protection.

The state may maintain “natural” monopolies through protection, but it has no fundamental role in granting privileges for their establishment. “Natural” monopolies are those monopolies that do not need help from the state to form, except through the enforcement of already-existing property laws. A “natural” monopoly can exist in any market in which, under existing property laws, a firm can gain economies of scale (or scope, for a “natural” monopsony), to such a degree that it begins to have a disproportionate share in the market. “Natural” monopolies often exist where large scale is needed and few firms are needed to supply the market, thus having strong elements of monopoly, without help needed from the state (except for protection of their unilateral claims to property).

It can be suggested that a “natural” monopoly is not truly natural, but an expression of the state, because it depends on the state to defend its property. These subsidiary monopolies to the state are considered “natural” because modes of property under capitalism are also considered “natural,” and so the obvious results of these modes of property (monopolies) will be considered such as well.

Many anarchists like to suggest that natural monopolies do not really exist at all, treating all monopolies as legal monopolies. While this may be true to an extent— in that governments protect the property claims of the monopolies, as discussed—, it is not always the case that monopolies arise in the context of a pre-existing state. Truly natural and “natural” monopolies, then, could be distinguished from one another by the fact that “natural” monopolies require the state or government to be maintained, while natural monopolies do not. However, the word natural gives the sense that it is the only way things can be. This is not the case. This being so, I like to refer to the state as a supernatural monopoly, though it is more commonly understood to be natural. The term is fitting, in my opinion, because the state depends on “the most dangerous superstition,” as Larken Rose puts it (the myth that it is needed).

The state itself, while not the only form of naturally-occuring monopoly, is an example of a natural monopoly, as it did not need a state to bring it into being or to maintain it. The fact that states exist demonstrates that natural monopolies do. Their status as monopoly is reduced, however, when decision-making power is shared. Without protection of their interests by using force, and without internal hierarchy, natural monopolies would simply constitute communities bound by mutual interest. However, they would cease to be monopolies at that point, as our discussion on panopoly will suggest. Natural monopolies are not natural in the sense that they are inevitable, and cannot be resolved, but only in the sense that they were not constructed or maintained by previously-existing human states. They can be superseded.

Monopoly, Monopsony, and Concentrated Ownership

Further on our list of distinctions, the term monopoly can refer to the bargaining power of selling parties in an exchange, as distinguished from an organized body of consumers, called a monopsony. Monopsonies are similar institutions to monopolies, in that they are unilateral bodies, but they exist on the side of the buyer rather than the seller. Monopolies, in this sense, refer to organized sellers who have the power of price manipulation on behalf of supply, while monopsonies refer to organized consumers, who have the power to manipulate prices on behalf of demand. An example of a monopsony would be a consumer cooperative that dictates prices to its producers, who aren’t organized into a monopoly. Were the producers to be organized in a producers’ cooperative, and the consumers in a consumers’ cooperative, however, this would constitute a bilateral monopoly. Bilateral monopolies occur when a monopoly and a monopsony co-exist in the same market. The distinction now being made between monopolies and monopsonies, we must also understand that the word monopoly can be used in a more general sense to refer to both monopolies-proper (on behalf of sellers) and monopsonies, or any imbalance of power. That is, monopoly has a general use, which can refer to both monopsonies and monopolies, or it can be used in a more specific sense as distinguished from monopsony. This being so, when I refer to the state as a monopoly, it is in the general sense, being both monopolistic and monopsonistic.

Another important distinction of the concept of monopoly includes matters of ownership or control. Monopoly can describe a situation wherein ownership is maintained unfairly, with concentration of power internal to a group, such as concentration of ownership into one or a few users among many. It is this concentration of power that truly distinguishes the state as a monopoly, rather than a common institution of shared benefit. The state is not alone in expressing this trait, as the monopolies it enables oftentimes share in it, becoming particularly obvious when equal labor does not supply an equal share of ownership. A landlord, who receives a rent check above the amount of effort used in maintaining the land, or the employer, who receives a hefty profit above the amount of labor put forth in the business, are each instances of this kind of organizational monopoly. These individuals do not work more to gain more and maintain more ownership. While these monopolies are usually enabled by forces external to them, such as the state’s enforcement of negative property rights in land, or its granting of positives privileges to provide labor, this is not always the case, particularly in regards to the state itself. The state is a natural monopoly, but unlike subsidiary “natural” monopolies, which are granted by the state, the state has been granted legitimacy by the passivity and ignorance of the people, who refuse to understand their condition, or to labor to change it. In this case alone, the granter of the right of monopoly is the weak will of the people, rather than a separate state. Unlike the other “natural” monopolies granted by the state, the state has been granted by the toleration of its people alone, and can actually be considered natural, but not inevitable.

Doing Away with Monopoly

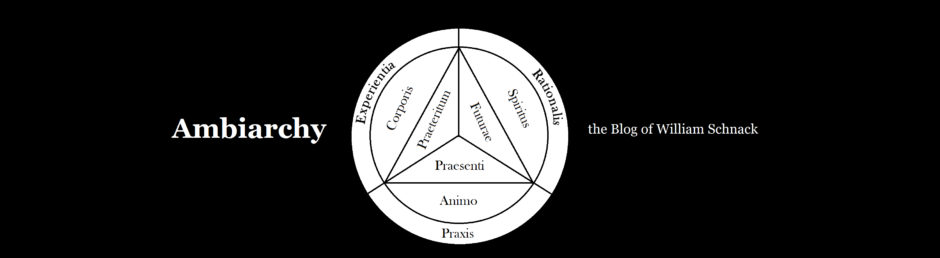

Is it possible to have the absence of monopoly? It certainly is. Geo-mutualists propose to end the monopoly of the state by eliminating the ignorance on which it depends. We would end its subsidiary “natural” monopolies through the enforcement of highly positive, rather than exclusively negative, rights to property. We wish to end artificial monopolies through the end of privilege-granting (such as subsidies, licensing, etc.). We propose to end the monopolization of ownership through cooperative models of shareholding and decision-making. We propose to end the battles between monopolies and monopsonies through combined strategy in joint-interest cooperatives and mutual firms. As such, the only remaining structure is certainly a joint venture, but cannot be considered a monopoly, perhaps a pan-opoly. Mono-poly, after all, describes one in control among many, while pan-(o)poly describes shared control between all of the many involved, with each sharing in power while maintaining their own identity. Monopoly simply cannot exist under conditions of balanced consumer-producer interests, egalitarian firm governance, the elimination of privilege, and property-allocation by contract.

The goal of the geo-mutualist should be to educate people (especially local) on the matters of geo-mutualism and to work with those who are like-minded to establish geo-mutual institutions, most important being the geo-mutual bank (but which may not be the best step for a group of, say, three people, among whom a small agorist business may be more appropriate). This, of course, must be kept under the radar until such a point that the bank has the potential to start enforcing its core values through defensive action. Once it gains power, however, as I have described in “The Civic Bank” and in “A Geo-Mutual Panacea,” it has the potential to enforce the interests of workers, through various programs. One such program can include the balancing of monopoly interests. This would entail the lending of capital to markets in need of monopsonies or monopolies to balance their countervailing forces. This entails the willingness of the bank to loan to consumers who are facing the oppression of producer monopolies, or producers facing vice versa.

Bilateralization and Mutualization

A geo-mutual bank is the best means of managing natural monopolies. This is best done through lending programs centered on balancing consumer and producer interests. While traditional banks lend primarily to producers, geo-mutual banks have much potential to lend also to consumers in need of monopsonies as well. Rather than deciding the viability of such an institution around income, it can be decided around the savings that loans can provide for their consumers.

It is well known that associations for professionals provide those professionals with a great deal of benefits. Many of these benefits include keeping salaries artificially high for the professionals, either by way of lobbying or through price-collusion, leading to much profits. This being the case, consumers have much potential for savings by creating similarly-powerful consumer organizations, which may act in concert in their consumptive habits, for the purpose of price-negotiation.

Just as producer monopolies, such as professional associations, have the means to influence prices on the side of production and selling, leading to higher rates of profit, consumer monopsonies, such as buyers’ clubs, have the means to influence prices on the side of consumption and buying, leading to higher rates of savings. These savings, which can equal the firm’s otherwise profits, can be used to pay back loans for capital, either real or mental, that has been used on behalf of the consumer organization, in the same manner that income used by a producer’s firm pays back loans used to generate their business. Imagine a bank that would lend in favor of a labor union (which is a monopoly on labor; employers are monopsonies/oligopsonies on labor) strike support, based on calculated probabilities of victory and returns. If, say, workers were to gain $1/hr. after a strike, it may be worth a mutual bank to lend toward a few days’ worth of strike support, enough to win the battle. After the victory, the workers would pay the loan back, interest-free, from their new wages.

The only matter of concern is whether or not there are savings to be had in such concerted activity as consumer price collusion. If there are profits made in monopoly, there are savings to be had in monopsony. It is also possible to lose, rather than gain, from group activities, however. Consumer and producer organizations alike are expected to be governed by rules related to ideal firm size, and can suffer from diseconomies of scale or scope.

The most likely outcome of a situation of bilateral monopoly, created purposefully by a geo-mutual bank, is the combination of consumer and producer interests in a mutual firm or a joint cooperative of some fashion, whereby consumers and producers share control. They may share control by way of a decision-making partition (wherein certain decisions are allocated to certain parties, such as methods of production to the producers, and the amount to be produced by the consumers) or by way of group decisions. Some mixture of both is most likely, with decisions relating to prices being of joint concern, while quantity is probably best left a matter of demand, and method a matter of supply.

Cooperation and Competition

The bank prevents the monopolization of ownership and decision-making power in subsidiary institutions by not providing privileges, not protecting disputed claims to property, and ensuring that all have credit with which to buy into organizations in which they share a stake, such as cooperatives. However, the participants in the organizations must also do their part to ensure that they remain internally egalitarian. If power is allowed to rise, unchecked, and to establish itself as an authority, and if members are not to take the action to prevent it, even the bank cannot prevent the internal monopoly of its subsidiary units. Luckily, most internal monopolization in today’s firms is actually due to unaccounted for external forces— such as property laws and privilege, which is granted to one among many, and thereby selects the leader for the firm— and not to the lack of virtue on behalf of the firm’s participants. Still, it is plausible that lack of virtue can allow for the rise of charismatic leaders, even if it is not very probable. For this reason alone it should be addressed, not because it is of near as much concern as macroeconomic forces of property and privilege.

“Natural” monopolies are granted by an artificial amount of negative protection of property rights, but more traditional legal monopolies are creations of positive privilege-granting. For artificial monopolies to be eliminated, positively-granted privileges— such as patents, zoning, charters, licensing, etc.— must cease to be required for operation. For those monopolies considered to be “natural” to disappear, those privileges inherent in our current system of perpetual land tenure must be removed, and economic rent, as well as its spurious returns, must be shared in by the community. Under geo-mutualism, artificial property claims will give way to property by contract (bid and rentshare), and economies of scale or scope will be matched by equal funding on the other side. Artificial monopoles will not be created by way of mandatory regulations or unfair privileges. Competition will be ensured.

Traditionally, banks have gained by supporting monopolies, and have been able to claim some of the monopoly’s profits for themselves, but such banks are also internally monopolistic, having strong hierarchies. The geo-mutual bank must be made accountable to its membership through participatory decision-making processes, which give it no incentive to enable profiteering, as there is no class of executives to capture the profits for themselves in the form of interest. Instead, a geo-mutual bank, owned and operated by the community of its users, is incentivized to promote balance in the economy. This entails promoting competition and lending to countervailing economic institutions, rather than favoring one side at the expense of another, and claiming some of the loot. Capitalist banks gain in the creation of monopoly, as they can claim some of the profits in the form of interest; but mutual banks lack the hierarchical class of executives to benefit from extortion and privilege-granting.

Panopoly

The duty of the geo-mutual bank is to challenge the power of the state as the source of subsidiary monopolies. This is best achieved by educating people through direct-action. In so doing, it will challenge the grantor of those monopolies, the state. By providing better means of relation than that of the state, and by providing more material efficiency than the state, the geo-mutual bank also challenges the very principle of the state.

The primary tool against the state must be education, but education must be followed by direct-action for it to be of any value. Revolutionary change must naturally be preceded by education, which will inform action contrary to the desires of the state, thereby calling into question its legitimacy. Direct-action is education by the deed, but before deeds can educate people, ideas themselves must be spread. Then they can be put into action by a particularly daring, capable, or enabled group or individual. Education-pure leads to demonstration leads to duplication.

The first step of establishing the bank is likely the most important. This involves creating a new social contract that does not enable the internal monopolization of the bank, but keeps it “panopolistic.” So long as the central institution of an economy, be it a state or a bank, remains internally monopolized, those who have monopolized the institution will promote subsidiary monopolies, from which they may draw some profit. This being the case, the geo-mutual bank must be a voluntary membership-based institution that maintains a model of participatory decision-making and provides real services to its members. The bank has no incentive to protect artificial and disputed property rights with force, will no longer have reason to provide some with privileges that others do not share in (unless they are already privileged by the state), and will issue credit in a way that more properly distributes the wealth and power in society, thereby confronting the state with a dispute of title allocation. Being more materially efficient, fair, and emotionally satisfying, without promoting monopolies, “natural” or artificial, the geo-mutual bank has many competitive advantages over the state.